Cfd trading

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables Versus Trade. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

When purchasing a stock through your broker’s trading platform, your broker holds the shares (or, share certificates) on your behalf. As the shareholder of record, you gain certain rights and privileges – such as voting and taking part in proxy meetings. You also become eligible to receive potential dividends.

In order to find one that meets your needs, you need to look at what markets the CFD platform offers, how much it charges in fees and commissions, and other metrics surrounding regulation, payments, and trading tools.

Cfd trading account

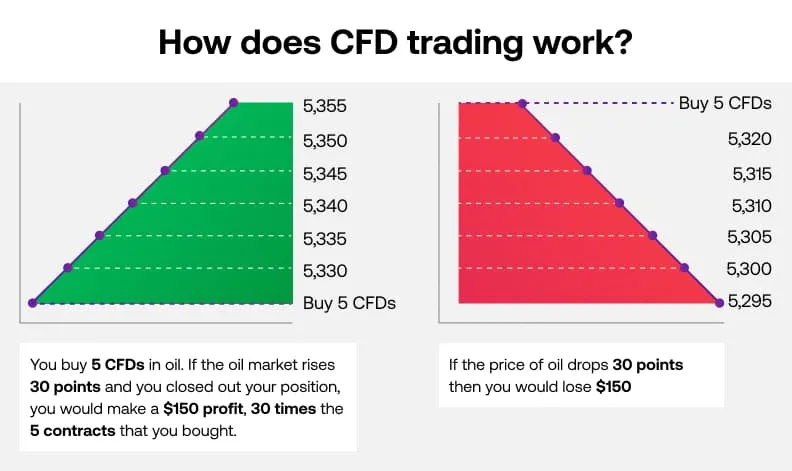

Going short involves selling a CFD with the expectation that the price of the underlying asset will fall. Traders profit from the price difference between the entry point and the exit point when they close the position. If the market moves in the expected direction (downward in this case), the trader makes a profit. Going short allows traders to profit from declining markets, and it’s a way to capitalize on assets they believe will lose value.

Range Trading: Identify price ranges where an asset has historically shown support and resistance. Buy near support and sell near resistance, taking advantage of price fluctuations within the range. Remember to use oscillators like the Relative Strength Index (RSI) to spot overbought or oversold conditions within the range.

Plus500 is known for its intuitive platform and offers a comprehensive range of CFDs, including stocks, commodities, indices, forex, and cryptocurrencies. It provides a risk-free demo account and is suitable for beginners.

CFD trading is subject to regulations but some jurisdictions lack regulation, but the level of oversight varies by jurisdiction. However, traders should use regulated brokers to ensure fair and transparent trading conditions.

Tax regulations are highly country-specific. Some countries may have favorable tax treatment for certain types of financial trading, while others may impose stricter rules. Always check with local tax authorities or consult a tax professional for the most accurate information.

Cfd meaning in trading

(This means that you will not be entitled to shareholder benefits. Though in some cases dividend payments may be ‘factored in’ to the value of your CFD contract. For a detailed guide on the specifics of dividends within CFD contracts)

Trading using leverage can incur overnight financing fees. These might not be large but still need to be factored into your strategy planning. In fact, these fees are one of the main reasons that CFDs are primarily used for short-term trading. If investing in CFDs over a longer period of time, the fees incurred could negate any potential profits or exacerbate any losses.

eToro (Europe) Ltd., a Financial Services Company authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under the license # 109/10. Registered in Cyprus under Company No. HE 200585. Registered Office: 4 Profiti Ilia Str., Kanika Business Centre, 7th floor, Germasogeia, 4046, Limassol, Cyprus eToro (UK) Ltd, a Financial Services Company authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263. Registered Office: 24th floor, One Canada Square, Canary Wharf, London E14 5AB eToro AUS Capital Limited is authorised by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139 Registered Office: Level 3, 60 Castlereagh Street, Sydney NSW 2000, Australia eToro (Seychelles) Ltd. is licenced by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License #SD076 Registered Office: Suite 18, 3rd Floor, Vairam Building, Providence, Mahe, Seychelles, is licensed to deal in securities either as an agent or principal. eToro (ME) Limited, is licensed and regulated by the Abu Dhabi Global Market (“ADGM”)’s Financial Services Regulatory Authority (“FSRA”) as an Authorised Person to conduct the Regulated Activities of (a) Dealing in Investments as Principal (Matched), (b) Arranging Deals in Investments, (c) Providing Custody, (d) Arranging Custody and (e) Managing Assets (under Financial Services Permission Number 220073) under the Financial Services and Market Regulations 2015 (“FSMR”). Its registered office and its principal place of business is at 25th Floor, Al Sila Tower, ADGM Square, Al Maryah Island, Abu Dhabi, United Arab Emirates (“UAE”).

The spread on the bid and ask prices can be significant if the underlying asset experiences extreme volatility or price fluctuations. Paying a large spread on entries and exits prevents profiting from small moves in CFDs, decreasing the number of winning trades and increasing losses.