Education loan obligations will be an enormous burden getting homebuyers, postponing agreements as well as resulting in some to put off homeownership altogether. But the Biden Administration’s student loan forgiveness can offer certain relief when confronted with ascending property will cost you.

Reducing – and possibly removing – loans plenty through this grant system usually boost financial obligation-to-income ratios for almost all individuals. This may let change significantly more renters for the home owners throughout the future age.

Individuals can now get pupil debt settlement

The insurance policy – earliest revealed in the August – are a beneficial three-region plan that can forgive up to $20,000 during the student loan obligations to have reduced- and you can center-income borrowers. So you can be considered, your yearly money both in 2020 and 2021 need to have started significantly less than $125,000 as one otherwise significantly less than $250,000 since children. Programs would be discover until .

Exactly how college student loans influences real estate

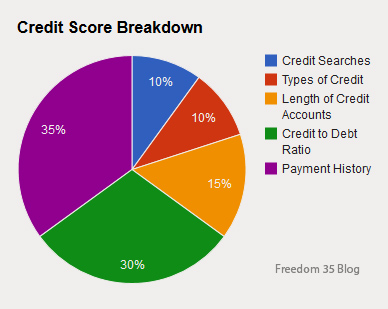

An option scale loan providers use to know if a debtor qualifies for a loan are debt-to-earnings (DTI) proportion. DTI compares their monthly debt payments towards disgusting monthly earnings and shows whether you really can afford and make your mortgage payments.

As DTI exercise your own monthly financial burden, moreover it will give you a sense of how much cash household your can afford. When you’re several affairs determine home loan qualification, loan providers keeps set DTI constraints to possess consumers. People ratio limitations are different from the mortgage form of:

- Old-fashioned financing: To 43% usually enjoy (36% is best)

- FHA financing: 43% generally speaking acceptance (50% is achievable)

- USDA mortgage: 41% is common for some loan providers

- Va loan: 41% is common for almost all lenders

Education loan financial obligation caused 51% of all of the individuals to get out-of or decelerate buying property in the 2021, based on a national Relationship of Realtors questionnaire. Subsequent, about twenty five% of all latest homebuyers and 37% of very first-timers had education loan obligations, which have the typical level of $29,000.

If you feel such as for example obligations try holding you back of homeownership, you will definitely Biden’s student loan recovery plan really make a difference?

Will scholar credit card debt relief make a dent? Just what experts thought

Brand new Biden Administration’s program is expected to incorporate scores of scholar loan debtors which have monetary save. Of several up coming ask yourself just what decimal effect of shorter financial obligation plenty was toward property.

It might [has more substantial feeling] from inside the a year or maybe more whenever house were in a position to proceed their house to order timeline by having quicker obligations the.

I expected a trio out of housing market experts because of their feedback toward number. When you find yourself indeed helpful for those people trying loans aid, the impact on the actual property sector might possibly be minimal. Here’s what they had to say:

With respect to the Light Household, the program will give relief in order to to 43 million consumers, as well as canceling the full remaining equilibrium for more or less 20 million borrowers.

Having potential home buyers that towards margin, the debt recovery you may let them make use of the currency you to definitely would definitely education loan loans to store upwards to have an effective downpayment. Additionally, it may counterbalance some of the cost losings out-of ascending mortgage costs since just what was previously a student-based loan commission can become element of home financing payment.

Really don’t believe education loan forgiveness will receive most of an effect on home buying. Customers have had their payments suspended for some time now, and they’ve got were able to either lower finance otherwise establish discounts.

Lenders supply were able to make adjustments in addressing pupil money to own borrowers before this bundle was at set, meaning the internet work for is very short. This may, yet not, features a somewhat big feeling inside per year or maybe more whenever houses had been capable proceed their property to purchase schedule insurance firms quicker financial obligation outstanding.

Given that education loan forgiveness work might help some individuals move from renter so you’re able to buyer, it’s unlikely we are going to observe that happen in large numbers. To have individuals whoever personal debt might be considerably eliminated, they probably have eligible to a home loan even after you to financial obligation.

For individuals having half a dozen-shape education loan debt, the new $ten,000 forgiveness probably will not be adequate to go the brand new needle. Your debt forgiveness you’ll cure a mental hindrance for some individuals who were vacillating anywhere between seeking to get a house and expenses away from a lot more of its student loan. However, once more, I question your number of individuals that it affects are certain to get a content affect overall domestic sales.

Student loans cannot stop you from purchasing a home

If you don’t qualify for the new federal pupil debt relief program or they merely can make a decreased impression, you might still rating home financing and purchase assets.

Lenders has actually self-reliance in their underwriting. They can be flexible from the education loan money, particularly when most money loans Wedowee AL other areas of the loan application – such as your credit history and you can deposit – are strong. Loan providers can even slow down the level of beginner personal debt it consider while into the an excellent deferred fee plan otherwise earnings-inspired installment package.

You undoubtedly can obtain a home which have education loan loans, mortgage pro Ivan Simental told you with the a bout of The loan Records Podcast. Simental recommends you to prospective homebuyers with student loan personal debt lose their DTI if you are paying off faster financing, remain its card balances lower, while increasing the fico scores when you can.

The conclusion

Merely big date will state exactly how college student credit card debt relief will assist household buyers. It will be easy your feeling might be minimal due to the fact to acquire an excellent domestic and you can paying your own loans off college commonly collectively private.

If you would like purchase property but do not discover if you meet the requirements on account of student personal debt, speak to a lender. Although the proportion is above the regular limitation, there might be exceptions or some other home loan particular that ideal suits you.