Home ownership try a cherished fantasy and you will a life threatening milestone to have members and their family members-particularly for those with high school students and people who just starting out, it includes balance and a charity to have strengthening an effective financial future.

Yet not, for some teachers and you may knowledge gurus, that it aspiration holds even greater importance; due to the fact instructors, they are towards front contours from shaping minds and nurturing the fresh next age bracket.

Fortunately there are specific financial options made to meet up with the unique demands of your children’s educators. By firmly taking advantageous asset of these types of certified software, instructors and other degree advantages discover reasonable financing and lower rates of interest or take benefit of advance payment guidance.

The nice Neighbors Next-door System

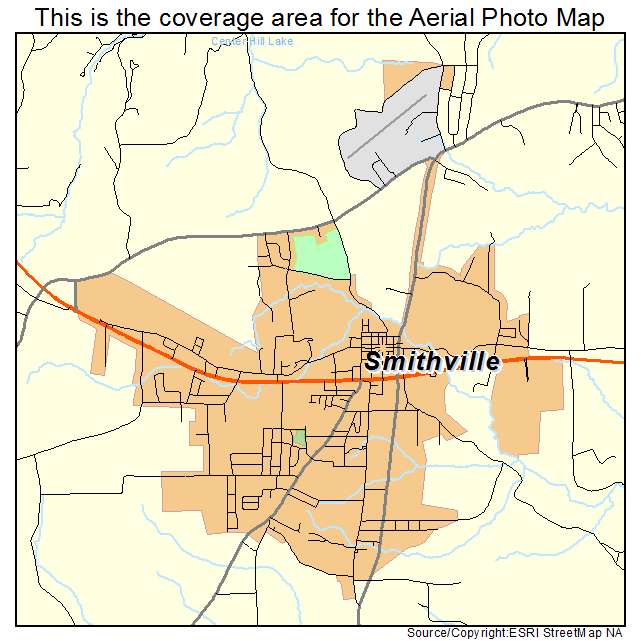

The great Neighbors Next door System, situated by You.S. Agencies out of Houses and you will Metropolitan Innovation (HUD), stands https://paydayloancolorado.net/pueblo-west/ as a beacon away from chance of coaches and you may knowledge benefits. This program will revitalize designated section through providing eligible participants a fifty percent dismiss toward HUD homes.

To qualify, educators must see specific conditions, in addition to working complete-big date because a great pre-K courtesy 12th-levels teacher at the a community or private college; while doing so, they want to agree to staying in the newest ordered possessions as his or her first home to have at least 36 months.

It is essential to keep in mind that the favorable Next-door neighbor Across the street Program has particular app attacks and you can accessibility may differ according to place and supply of HUD house. Listed below are some even more detail below, otherwise connect with a city Mortgage Advisor to learn more.

Good neighbor Across the street: Secret Professionals

- $100 downpayment available options which have FHA qualification

- Substitute for promote the house or property once 36 months and continue maintaining the brand new security and admiration

- Range mortgage factors offered, as well as FHA, Va, and you will Traditional loans

- Possibility to combine with a restoration financing for additional renovations

HomeReady Mortgage

Others home loan solution one gurus educators and you may education benefits was the fresh new HomeReady Mortgage program; this option, given by Fannie mae, was designed to make homeownership a lot more accessible to possess reasonable- to help you reasonable-money individuals, also educators.

That secret benefit of HomeReady ‘s the versatile certification conditions; they takes into account non-conventional sources of earnings, for example area rental earnings or money regarding family traditions in identical house. This can be very theraputic for coaches who s or discover service regarding household members. At the same time, HomeReady allows money away from non-borrower loved ones, for example parents otherwise siblings, become experienced when deciding mortgage eligibility.

What’s more, it also provides a low-down payment alternative, that will be only 3 per cent; this will be a massive brighten to possess education professionals who possess restricted offers to get with the a down-payment. Like many old-fashioned mortgages, clients have to pay getting private mortgage insurance if the down payment was less than 20%. Yet not, advanced is actually less to own HomeReady-eligible consumers, that helps keep monthly premiums less so long as the latest debtor renders 80% or a reduced amount of the space Average Earnings (AMI).

HomeReady do provide knowledge and you can support in order to individuals, and an important on the web homeownership degree direction. This program assists individuals acquire a far greater knowledge of the house-purchasing procedure, monetary administration, and you will obligations of this homeownership. Follow this link for more information.

HomePossible Financial

Supplied by Freddie Mac computer, the newest HomePossible Financial program needs reasonable- so you can average-money individuals, plus instructors, shopping for a very obtainable way to homeownership. Whenever you are HomePossible shares some parallels with HomeReady, like flexible deposit options and reduced private financial insurance rates (PMI) premiums, you will find noteworthy variations.

HomePossible set the absolute minimum credit history tip of 660 to buy transactions; if a customer’s credit rating drops anywhere between 620 and you can 660, HomeReady is the better choice.