Borrowing Karma are an internet site which provides a free service one to enables you to look at the credit rating and account. In britain, Borrowing Karma spends TransUnion’s scoring program, hence selections out of 0 so you’re able to 710. TransUnion’s assortment differs from most other credit agencies for example Experian and you will Equifax, with their particular scoring options.

In the event the rating was 285 to the Credit Karma, then you definitely belong the fresh Less than perfect classification towards TransUnion. This can really curb your options for things such as financing, handmade cards, otherwise mortgage loans.

The thing that makes my personal credit score 285 into Credit Karma?

A decreased credit history might be because of multiple reasons, but always while in the Less than perfect category it is down to around three anything:

- You could have recently defaulted into financing, or possibly received a courtroom view (CCJ) facing you getting unpaid costs. This can be entitled that have less than perfect credit.

- You have recently relocated to the united kingdom and there is simply zero analysis for TransUnion to learn while a responsible debtor your home country credit score wouldn’t move into the uk. This will be titled that have a finer credit history.

- Or you could just be not used to borrowing from the bank some other explanations, such merely flipping 18. A unique thin credit history problem.

How lousy could it be to have a great 285 credit score on the Credit Karma?

TransUnion (in which Credit Karma will get your get from) ‘s the UK’s third prominent borrowing reference agencies. When you’re reduced, a great amount of banking institutions and loan providers trust it when reviewing their borrowing application.

- Expect you’ll be declined of the most loan providers.

- Chances are you’ll fail most borrowing from the bank checks.

- And even when the accepted, it will be because of the specialised loan providers who can fees extraordinary attention costs and you will fees, and offer lower borrowing wide variety, lower borrowing from the bank limitations, or notes without perks otherwise cashback.

- Whenever leasing, it will be easy you to letting firms you are going to inquire about a bigger deposit.

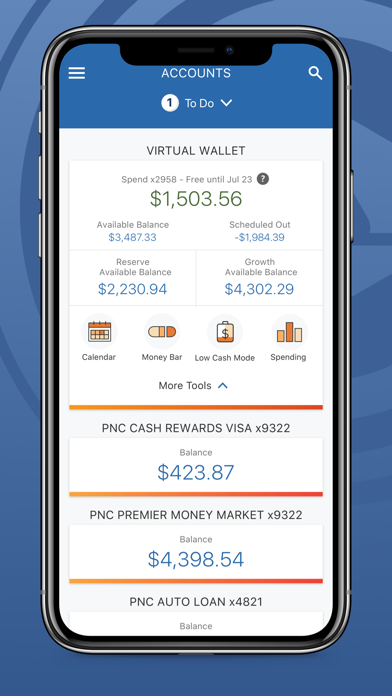

- Whenever opening a checking account, you may not be offered an overdraft option. You’ll end up restricted merely to first bank account otherwise prepaid debit cards.

- If you are looking to obtain a mobile package which comes towards the latest tool, you happen to be rejected too since this matters as a beneficial mortgage with the phone’s worth.

How to improve my personal 285 Borrowing from the bank Karma rating?

To start with, with a great Sub-standard credit rating for the TransUnion doesn’t mean which you can get one for the Equifax otherwise Experian. Each institution will get a little some other analysis and you may calculates your own rating in another way. Very consider those score also observe where you’re.

Second, you are able to only have errors in a single credit reports if your Credit Karma score is a lot less than what you discover into the ClearScore or Experian, check your TransUnion credit file and you can best something that may appear out of.

Fundamentally, day work on the go for. Whether your low credit rating ‘s the outcome of some errors prior to now, their impact commonly diminish through the years. Lenders will desire more on your current credit rating, also.

Just in case your lowest credit rating is basically because you’re the brand new so you can borrowing from the bank, after that cash advance loans Brookwood AL having credit plans where you make costs promptly you can expect to change your credit score rapidly.

Wollit builds your own borrowing from the reporting your registration given that financing payments towards the around three big credit reporting agencies, as well as Equifax, and that Borrowing from the bank Karma spends. Which strengthens your credit score, the the very first thing to suit your score.

In the course of time, this will help reduce the effect regarding past mistakes or an effective thin credit rating in your TransUnion document. Give it a while, and you will just end up for the a better borrowing score ring.