While the Department off Pros Affairs backs Va money, we are able to present a mortgage having significant monetary professionals unmatched from the other kinds of money.

Pick a home in the place of a https://paydayloanalabama.com/tarrant/ down-payment. Simple fact is that most significant advantage of this new Virtual assistant loan, especially for very first-date homebuyers whenever home values try rising. It considerable virtue enables you to individual a home without wishing years to save.

Never ever shell out home loan insurance coverage if you are using a good Va financing in order to purchase a home, regardless of if the down payment try 0%. As a result, the loan fee is lower, so you can pay for a very pricey house.

The average interest to own a great Virtual assistant financing is lower than a normal home loan. After as well as your Va Financing Rate Make sure out-of NewCastle Mortgage brokers, you are able to contain the cheapest price in your loan and savor a keen sensible payment per month in your house.

Shell out reduced to own closing costs when you get your Va mortgage with NewCastle Lenders. Basic, the newest Virtual assistant restrictions the costs lenders can charge experts. Also, i waive all the origination fees to possess pros. Unlike most other loan providers, do not charges veterans a charge for originating your home loan. As a result, you could potentially save an additional $step 1,000 for only having fun with all of us.

Whilst Virtual assistant helps make the regulations getting Virtual assistant fund, private loan providers such NewCastle Home loans have additional standards getting borrowing, financing amounts, and property items.

Your credit score have to be about 580 having good Virtual assistant mortgage that have NewCastle Home loans. An effective 580+ get form your meet the lowest practical. However you still need to incorporate and you may give us debt advice ahead of we agree the loan. Thus start now through getting pre-approved thus you’re prepared to make the most of most of the possibility to get a house.

Having complete entitlement, you might borrow as much as $766,550 to buy an individual-friends, condo, or townhome. Or rating a bigger loan getting a multi-tool property without needing a deposit. Virtual assistant funds assist veterans and you can service users get residential property to live in full-day. Therefore the assets need to be the principal residence, perhaps not a good investment otherwise trips home.

- New Va loan restrict was a cap into count you can be acquire rather than a down payment. Therefore, you could potentially borrow over the newest limit when you have a beneficial down-payment.

- The 2024 Va financing maximum is actually $766,550 in the Florida, Illinois, Indiana, Michigan, and Tennessee. Yet not, mortgage limitations is actually large within the Key Western, Florida, and you will Nashville, Tennessee.

- Dominant house, next house, or money spent?

- 2-to-4-Product Household | Simple tips to purchase a multi-equipment possessions

- Vendor Credit | Can the vendor afford the homebuyer’s settlement costs?

You will find solutions to faq’s.

A good Virtual assistant loan is a mortgage which is guaranteed from the the new You.S. Company out-of Experts Affairs (VA). Its available to army pros, effective responsibility members, and you may partners. Its built to help them be able to pick a home.

One of many benefits of a great Virtual assistant mortgage is the fact it doesn’t want a down-payment or mortgage insurance policies, which makes it easier for armed forces borrowers to cover the property. Va money supply much more easy borrowing from the bank and money requirements than old-fashioned mortgages, making it simpler getting army consumers so you can meet the requirements.

At the same time, Va funds enjoys straight down settlement costs and you can rates of interest than of several other types of mortgages, that save your self individuals currency along the life of the loan.

Keep in touch with a great Virtual assistant loan specialist within NewCastle Home loans to possess straight solutions, to see the direction to go in your mortgage.

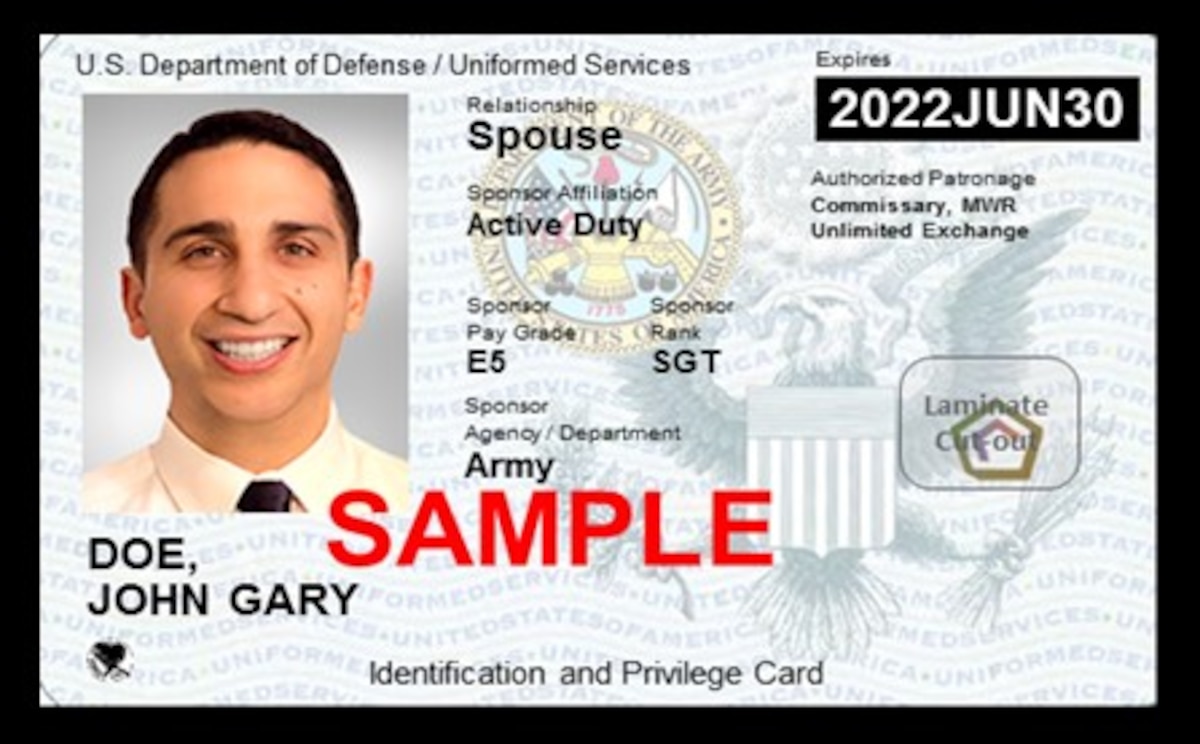

First, i prove you may be eligible for a beneficial Virtual assistant loan from the checking your own Certification regarding Qualifications (COE), appearing you meet up with the lowest services criteria. Second, i make certain you qualify for the new Va financing.

Then, once all of our mortgage underwriter, anyone putting some last financing choice, confirms your financial pointers, you earn a personalized pre-recognition page on the same big date.

Next, you are happy to find the prime home and you will end up being confident in the and work out an offer. Do you want to begin?

NewCastle Lenders also offers Va money so you’re able to armed forces teams and you can experts, and the minimal credit score is 580. It means you can aquire accepted to own a reasonable Va financing in case the credit history is 580 or even more. After that, use your Virtual assistant mortgage to purchase a home no off fee, and luxuriate in a minimal rates and you will payment per month with no mortgage insurance. Find out more about Va financing credit ratings.

This new Virtual assistant financing fee was a percentage of the loan amount. The actual price may vary dependent on several activities, like the sort of Va mortgage, whether you’re an initial-time or repeat debtor, along with your downpayment amount.

- dos.3%, when your down-payment is actually lower than 5%

- step 3.6%, if your deposit was lower than 5%