If you need money having an enormous pick otherwise disaster you want, you can envision borrowing from the bank from your thrift savings bundle. See how to borrow of good thrift deals plan.

Government personnel and you can people in new uniformed services may be qualified so you can use off their Thrift Coupons Plan. A teaspoon loan lets users in order to borrow using their old age membership to finance a massive costs otherwise safety disaster expenditures. Teaspoon money was enticing when you are borrowing out of oneself and he has got a low interest.

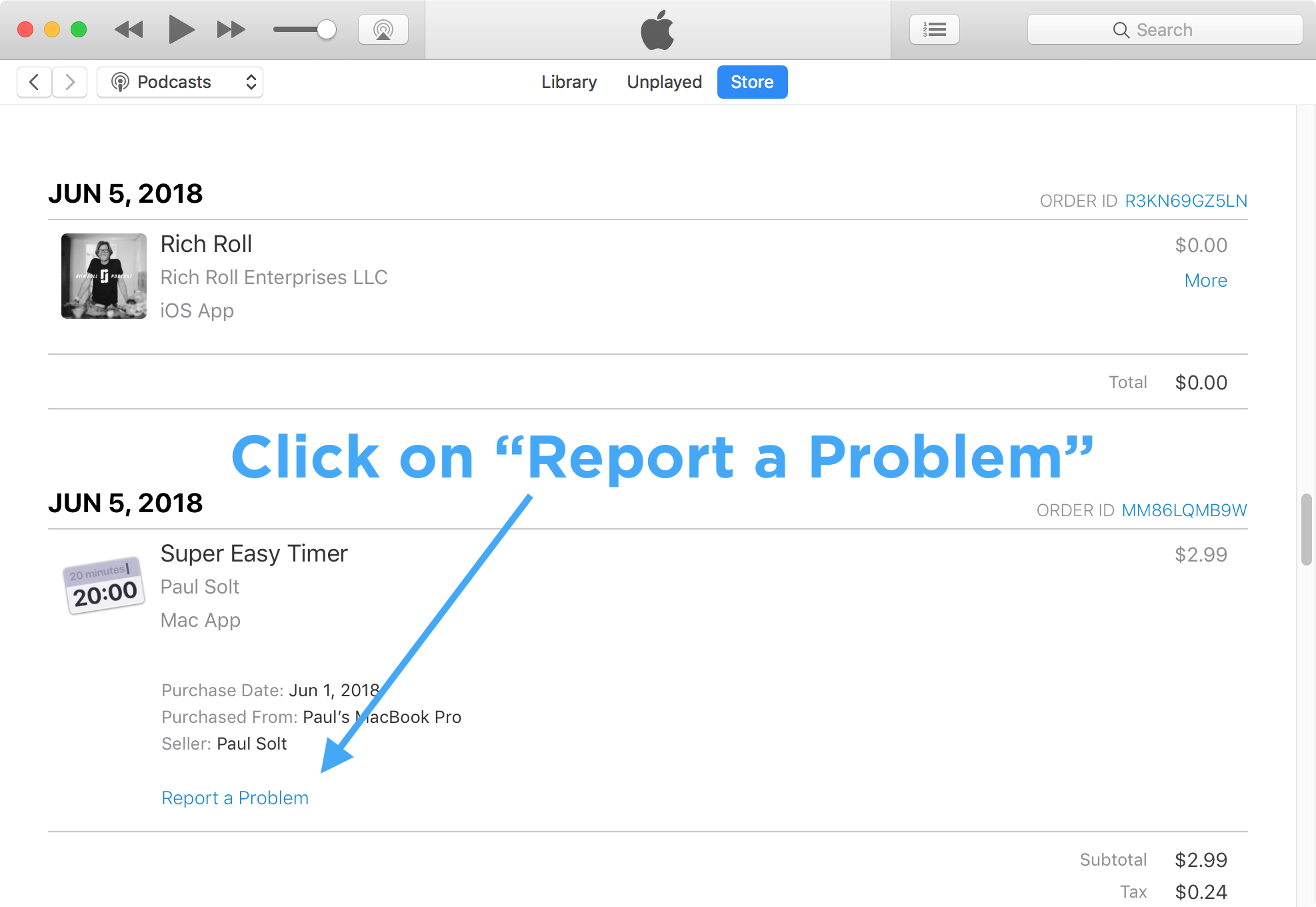

You can use a tsp mortgage by the processing an online application function toward Teaspoon webpages. Start by log in toward My Membership in the utilizing your username and password, and make use of the internet tool so you can submit the desired information, like the amount we want to use, the purpose of the mortgage, the latest company your work with, whether you’re partnered, etcetera. It is possible to be required to bring particular papers whenever filing from the application.

What’s a tsp loan?

A teaspoon financing are a plan loan which enables qualified players to faucet the old age discounts and you can spend the money for money in addition to interest back again to their account. Tsp money are like 401(k) funds as the each other arrangements allow users so you’re able to acquire from their old age coupons, but Tsp finance are designed for federal experts and you may members of this new uniformed services.

You could potentially take both a tsp home loan or a tsp general-mission mortgage. For people who use a teaspoon financial, you need to use the mortgage continues to acquire otherwise build your principal quarters, in fact it is a home, condo, cellular domestic, or Camper family, as long as you will use your house as https://paydayloancolorado.net/battlement-mesa/ your number 1 house. In the place of a traditional mortgage, a teaspoon home loan doesn’t make use of your domestic because guarantee with the loan. Tsp home loans keeps a fees age of doing fifteen many years.

By firmly taking a standard-mission Tsp mortgage, you can use the loan continues just for anything- expenses scientific expenses, college degree, trips, roof repair, to find an automible, etcetera. General purpose Tsp funds keeps reduced repayment symptoms than simply Teaspoon family finance, and you’ll be required to pay off the loan in a single in order to five years.

Exactly how much could you borrow off a thrift savings plan?

The minimum Tsp mortgage you might borrow is actually $step one,000. But not, Teaspoon agreements keeps some legislation to determine the amount borrowed a fellow member can also be borrow off their old age membership.

You can’t obtain more fifty% of your vested balance, or $ten,000, whatever try greater, less one a great loan balance.

Ways to get a tsp mortgage

Upfront their Teaspoon loan application, you should always meet with the minimum conditions to possess Teaspoon fund. Generally speaking, you really need to have at least a $step one,000 balance throughout the Teaspoon membership, getting a recently available federal worker, and start to become inside “energetic spend” condition.

For those who meet with the Teaspoon loan standards, you can initiate the fresh new Tsp financing process because of the log in so you’re able to My personal Membership in the . The newest Teaspoon website enjoys a tool one strolls you action-by-action from the app process, and you should fill in the desired sphere and provide one requisite files. You could publish the fresh documents on the Teaspoon web site otherwise mail it to help you Teaspoon.

If you find yourself a federal Group Advancing years Solution (FERS) new member and you are partnered, your wife need signal the mortgage arrangement to help you say yes to the latest mortgage. And, while trying to get a teaspoon home loan, you are necessary to render files to exhibit evidence of our house you are purchasing and/or house we wish to purchase.

You might finish the Teaspoon loan application online. But not, in some cases, you happen to be necessary to print the applying and you may posting it in order to Teaspoon thru post or facsimile. For online software, you should buy recognized and discovered good disbursement during the two weeks. Sent applications usually takes weeks to find accepted and then make an effective disbursement.

Ideas on how to pay your Tsp financing

You ought to start making Tsp financing money within 60 days immediately following finding the fresh new disbursement. Constantly, when Tsp techniques the loan, it must alert your own agency’s payroll office so it can also be begin making payroll write-offs from your salary. The loan repayments come back to your Teaspoon account, consequently they are spent based on your investment election.

When you have split out-of services and you have an outstanding Tsp financing balance, you will still have to create mortgage costs. You could potentially plan to pay-off new the mortgage in one single lump sum payment otherwise continue and make financing repayments by evaluate, currency acquisition, otherwise head debit according to research by the same mortgage cost terms and conditions while the before separation. However, if you can’t pay the mortgage payments, you might allow mortgage as foreclosed, and one outstanding mortgage balance could be addressed as taxable earnings.

Should you bring a tsp mortgage?

If you want to borrow funds to own an urgent situation otherwise higher pick, a teaspoon mortgage is generally a good idea because it is a reduced-desire variety of borrowing money as compared to other large-focus loan options such as personal loans and you will bank card debts. You can just take a tsp loan to meet up crisis expenditures, purchase a house, pay scientific bills, or any other highest expenses.

Although not, you can find constraints with Teaspoon loans. Very first, when you borrow money from your own Teaspoon membership, you’ll overlook the earnings you’ll have raked for the had the money stayed regarding the account. When you was repaying interest to oneself, the eye money are often lower than what you could possess obtained. Together with, the eye repayments are not income tax-deductible, and also you would not make the most of an interest deduction when filing earnings taxation.