Exactly how much must i obtain? Its perhaps one of the most very important issues for an initial family buyer, but it is difficult to get an exact answer. Why? As the credit energy has evolved significantly for the past long time. Considering Loanscape, a household that’ll has lent $785,000 inside would just be capable use $583,five-hundred for the . So, how can you score an exact assessment of borrowing from the bank skill?

What is actually Borrowing from the bank Stamina otherwise Credit Ability?

Your borrowing ability is the restrict amount of cash a lender will be ready to mortgage your. The new borrowing fuel of men and women was influenced by activities as well as money, credit history, costs, current interest rates and private debt.

Today, the thing that makes figuring borrowing from the bank potential so important? Since until you know how much you might borrow, you will never know how far you might invest. An exact estimate of the borrowing from the bank fuel allows you to put a sensible cover your residence get. It will also help you assess your upcoming debt to ensure you could potentially manage your month-to-month repayments.

How much cash Do i need to Acquire?

- Most recent earnings and work balances

- Existing monetary responsibilities (financing, credit cards, living expenses, HECS-Assist debt, etcetera.)

- Credit score

- Duration of the mortgage identity

- Current rates of interest

- Measurements of the deposit

- Types of financing (fixed-rate otherwise adjustable-rate)

- Government credit standards and you may limits

This type of items will help expose your debt-to-income proportion, a good metric that lenders use http://availableloan.net/installment-loans-la/atlanta to assess your general monetary fitness. The latest proportion was computed by the splitting the full monthly personal debt repayments by the terrible month-to-month income (conveyed while the a portion). The low your ratio, more possible borrow.

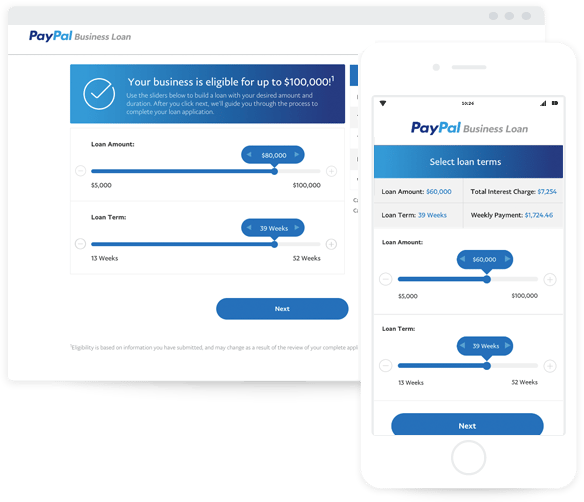

Having fun with A borrowing Energy Calculator

An on-line credit fuel calculator can be handy to possess quoting just how far you could potentially obtain. Permits one type in very first facts, such whether it is a shared software, level of dependents, interest rate, financing title, net income, average costs plus borrowing limit. Brand new hand calculators after that make use of this pointers to imagine your own borrowing capabilities.

While this are going to be a helpful determine whenever initial offered their possibilities, what provided with an internet borrowing stamina calculator are standard only. It won’t take all of your own activities into consideration. When it comes to positively figuring their borrowing power, correspond with a mortgage broker.

Common Errors to eliminate Whenever Figuring Borrowing Potential

- Miscalculating cost of living: Be sure to offer a reputable and you may thorough review. Believe every aspect, together with entertainment, resources and you can discretionary using.

Exactly how much Ought i Acquire? A situation Analysis

Sarah is actually going to buy their unique very first family. She has a powerful earnings, however, her borrowing capabilities is also dependent on their unique auto loan and you can monthly expenses. Sarah’s careful budgeting develops their borrowing fuel, but their own credit rating are lower (because of several skipped vehicles repayments).

Of the improving their unique credit rating, Sarah usually get finest financing terms and conditions and increase their particular energy. Knowledge and you may optimising these types of affairs ahead of time usually significantly help Sarah on the happen to be homeownership.

A brokerage Might help Determine The Borrowing from the bank Stamina

How much cash should i use? Its a significant concern. Calculating borrowing fuel will help you to establish a sensible budget and make arrangements for the future. Nonetheless it can be hard to contour that it on their individual. Within Northern Brisbane Home loans, the audience is dedicated to permitting earliest homebuyers get to their property control desires.

Our online calculators can also be part your regarding best assistance, but contemplate, they’re only helpful information. Getting a precise evaluation of your own borrowing from the bank potential, publication an appointment with Northern Brisbane Home loans.

Patrick Cranshaw, an authorized Home loan Professional for more than 21 many years, dependent Northern Brisbane Home loans into the 2002. Their career first started having ANZ Lender inside Brand new Zealand, in which he evolved over sixteen years so you can a corporate Financial character into the Virginia. Shortly after moving to Brisbane when you look at the 2000, Patrick provided the latest QLD marketplace for home financing service, helped build the REMAX A home Money division, and you may experienced since an agent.