Construction-Merely Mortgage

Because identity ways, a construction-just loan often entirely cover the building of your house. Due to the fact financing was small-title, you will have to submit an application for a long-term particular resource shortly after construction is more than. It indicates entry one or two independent applications when you look at the a span of you to definitely 12 months or less. Do not forget the brand new closing costs from the that it too.

Although you may should do far more records and provide extra data, construction-just funds provides you with the independence to search available for a far greater home loan. However, contemplate, the money you owe you’ll substantially changes just as you will get able to try to get it. For those who reduce your work, default to your bank card costs, otherwise one thing of your kinds, you will never be able to be eligible for a mortgage.

Restoration Financing

Investment home improvement ideas is possible that have a repair mortgage. You can utilize it loan for the property that require a tiny TLC instead of including zero. Such characteristics are considered fixer-uppers, and you can regardless if you are seeking live-in they or sell, they might be deserving opportunities when the done correctly. A treatment mortgage, such as for instance a good 203(k), will provide you with money buying and you can improve the house.

If you’re currently a citizen and would like to perform several renovations, you can re-finance the financial for a remodelling financing and you will complete the needed change. Additional options is taking a personal loan otherwise beginning another range away from credit to play do it yourself programs.

Owner-Builder Structure Mortgage

If you’d like to spend less, then you certainly should consider a manager-creator build mortgage. In place of being required to get high priced designers, you’ll end up usually the one responsible. However, this option isnt readily available for people. You truly need to have the required licenses, permits, and you may insurance policies, together with construction sense.

End Mortgage

An-end mortgage is actually another way to make reference to their mortgage. Just after design on your property is done, you are going to need to repay the finish financing. Discover an offer of one’s payments, have fun with a housing finance calculator.

Exactly what do Design Loans Security?

House construction loans will help you to tackle this new economic barrier ranging from you and this building of your house. But, what exactly is safeguarded around a casing financing? Your loan might possibly be familiar with pay

- Land can cost you

- Work

- Material

- It permits

- Fees

- And a lot more

When there is currency remaining immediately after structure is complete, you will not have the ability to utilize it buying furniture or decoration. Although not, the cash is applicable to long lasting fixtures, products, and you can surroundings.

Whilst application having a casing mortgage is generally similar to help you a fundamental home loan, a property financing is much more difficult. Here’s a brief step-by-step writeup on the construction mortgage processes:

- If you’ve decided you to a separate-depending house is right for you, start to look knowledgeable developers inside your area and you can talk with her or him. If at all possible, the latest creator is about to possess feel building the kind of possessions need and you will hold the needed certificates and you may insurance coverage. After you have narrowed down the decision https://clickcashadvance.com/installment-loans-id/boise/, inquire about an in depth plan.

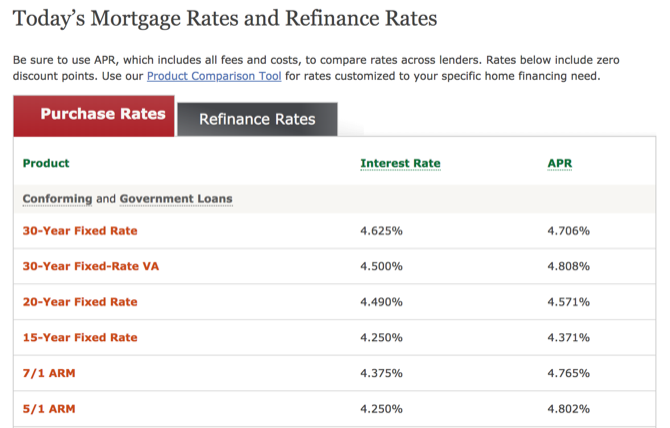

- Go for the sort of design financing you want and appear having experienced loan providers offering the ideal prices. During this time period, it’s adviseable to setup an introductory meeting or label to talk about your project.

- Provide the bank with essential economic data files, including your W-dos, tax returns, and financial comments.

- If you find yourself recognized towards the loan, you can easily meet add an advance payment and pay closing costs.

Think of, this really is a brief history off what you are build loan processes may look such as for instance. The loan sort of, financial, and you will subcontractors you will definitely alter the tips a lot more than.