Whether we want to decrease your monthly payment, reduce the complete matter you pay for your house or play with their residence’s collateral when planning on taking cash-out, refinancing would be a substitute for see debt requirements. It doesn’t matter your cause, it is critical to select the solution that really works right for you.

What is refinancing?

To put it differently, refinancing is getting a loan to exchange one you really have. But why should you should do you to? Here you will find the most commonly known grounds:

- We wish to reduce your monthly premiums

- We should spend your home out-of sooner minimizing the fresh quantity of attention you may be using

- We would like to just take cash-out to greatly help pay for an effective highest pick particularly a renovation, or even to pay-off high-desire debt

- We need to replace your financing sort of or name

Cash-out refinance

If you would like make use of the established equity of your property while making a huge buy or pay-off higher-notice financial obligation, an earnings-away refinance is an excellent solution.

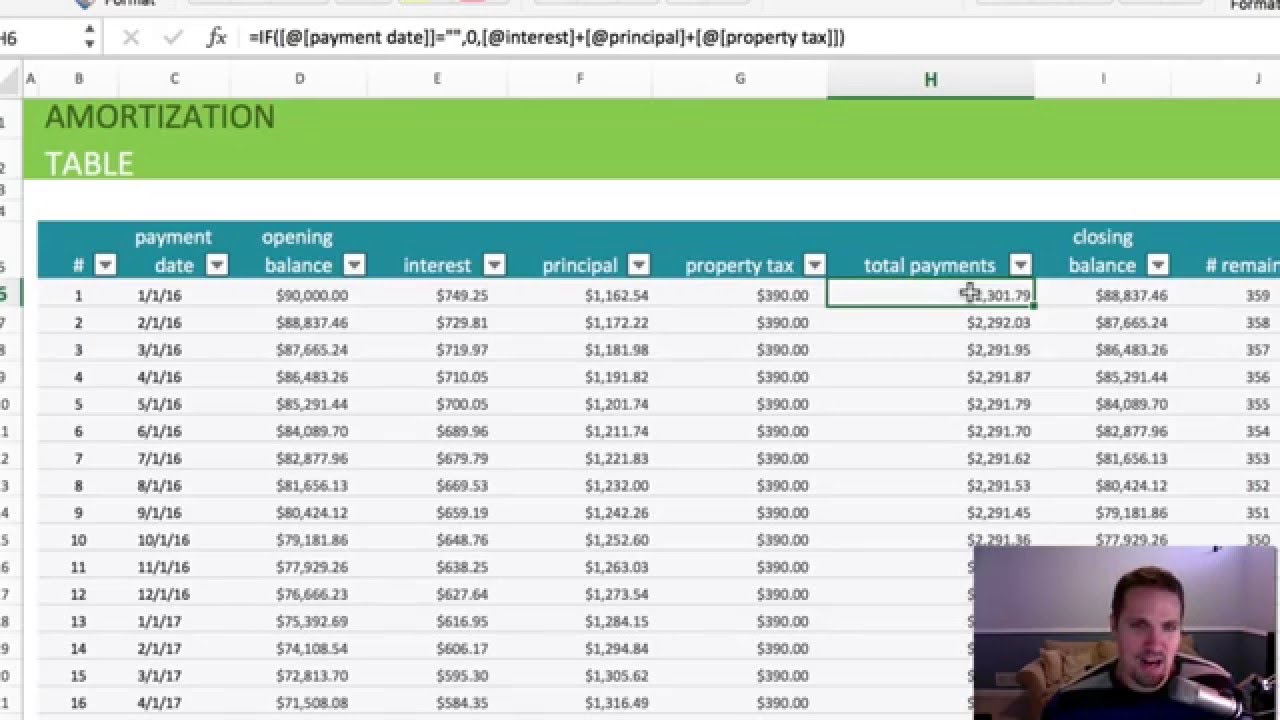

That have a money-aside re-finance, you’re taking for the a unique home loan that’s more than the principal balance of the most recent that. Your current equilibrium could be paid back, a different mortgage might possibly be launched therefore the harmony would-be reduced for you shortly after closing.

You are able to the money for such things as renovations the kitchen, adding onto your residence otherwise paying for college. However utilize it, its your own personal to store.

So you’re able to qualify for a finances-away refinance, very lenders need you to do have more than 20% collateral home you happen to be refinancing. Security ‘s the percentage of your house you paid in place of how much cash you still are obligated to pay. Including, to the property worthy of $2 hundred,000, you’ll need to keeps paid off $40,000.

Done properly, a profit-aside refinance makes it possible to convenience to your a hotter financial condition. Try to avoid utilizing the more income to fund something that won’t raise or improve your economic fitness, eg holidays. Placing the money to your house to improve its worth or paying off large-attract obligations is a smart way commit.

No cash-aside re-finance

A no money-away re-finance is a fantastic solution when you want to lower their payment, otherwise pay-off your property at some point when you find yourself decreasing the total count interesting you happen to be investing. Having a no money-away re-finance, you are taking on a different sort of financial that’s simply quite higher compared to existing equilibrium on your own home loan.

Seeking increase your cash flow? One of the benefits off refinancing is you can free up particular cash in https://paydayloancolorado.net/kiowa/ your finances by eliminating your payment per month. You can do this because of the refinancing for a longer period physical stature, such as for instance a 30-year fixed financing. Or, if you’re not likely to stay-in your residence for more than simply some more many years, you might refinance at a diminished rate of interest having fun with a variable-rate home loan (ARM).

When you need to pay back your residence sooner and lower the quantity of attention you’re purchasing it, you might refinance having a shorter mortgage title. When the rates of interest enjoys dropped, your e because it’s now, and pay off your home a few years prior to. Doing so might help you save thousands of dollars inside the desire across the longevity of the borrowed funds.

Initiate shopping, make inquiries

As you believe if refinancing your mortgage is sensible, keep condition and you may desires planned. There could be charge once you re-finance, together with settlement costs.

Remark your mortgage to find out if there can be a payment for paying it well early. If you have to pay a leading prepayment penalty, you may also hold off into the refinancing. And if you really have additional inquiries, an effective Pursue Family Lending Coach is happy to let.