A possible house consumer who would like to purchase a mature domestic that needs repair must look at the FHA 203k rehabilitation financing. This is exactly a beneficial federally guaranteed financial that allows you to definitely wrap a house update loan with the full home loan. Us citizens was cherishing homeownership given that their the beginning as well as the HUD gives the FHA family repair financing 203k for renovations, framework, rehabilitation and a lot more. This article will speak about the brand new FHA 203k loan requirements, professionals, settlement costs and 203K financing cost.

Its first mission is always to offer the best do-it-yourself investment solutions to have consumers that have all the way down credit ratings to facilitate the fresh new repair out of older services and you may fixer-uppers for use while the number one homes.

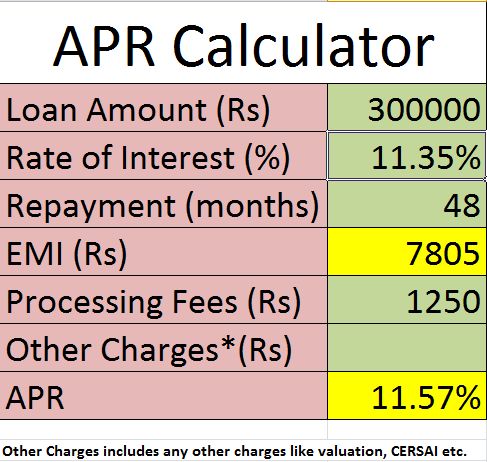

The new 203K rehab fund come given that both fifteen otherwise 31-year repaired-speed mortgages, or changeable-rate mortgage loans, demanding a minimum down-payment of step three.5% of your own combined possessions and you may resolve costs.

Such 203k treatment finance are insured of the https://paydayloancolorado.net/marble/ Federal Homes Administration, New RefiGuide will help you to know what the newest rehabilitation 203k mortgage is actually and just how they are able to changes your property update ambitions on facts.

The biggest virtue is you will pay a lower interest rate to your restoration mortgage than just you generally often everywhere more.

2nd, you could pay off the recovery financing along side longevity of this new mortgage, in the place of in a few many years, as with of a lot personal loans in addition to FHA 203K financing pricing are typically charged very competitively.

#1 Financial Pre-Recognition to possess 203K

Make sure that the loan creator has done FHA 203k rehab fund in advance of. You really need to query him/her if they can explain the whole 203k technique to you. Nonetheless they can make suggestions they have signed 203k loans before. In addition to, you need to get home financing pre-acceptance that distills the fresh new terms, restrictions and also the certified FHA 203k mortgage price. FHA mortgage standards are extremely clear, so ask your mortgage administrator what is needed locate recognized getting a good 203K loan program today.

#dos Understand Can cost you off 203 K Funds

A keen FHA 203 K mortgage is not for all of the consumer otherwise property. Originating these types of a FHA program takes additional time and you will assistance toward loan maker. Such domestic construction financing be much more complex there are more members with it, which could add a few weeks toward mortgage processes. You really need to consider such things when you’re to order a property that needs repairs. Also, make certain the purchase price you pay with the family shows the fact it requires fix. Which FHA loan system was created to promote lowest settlement costs and you may reasonable 203K mortgage pricing having household treatment.

#3 Obtain a good Company having Household Rehabs

This might be many vital basis when you get a beneficial 203k mortgage off FHA. We recommend that the thing is that recommended, licensed builders that your particular family unit members otherwise relatives purchased recently. You do not want to employ an associate date builder which have another day occupations. If the builder isnt educated, it will also be difficult to find the mortgage to experience. That is why we recommend that you interview several contractors and inquire about records.

Having a high level builder is important besides with the top-notch the fresh new rehab. The new builder must run new underwriter to obtain your or her this new documentation that is required to close off the mortgage. If the specialist will not display really, this may steer clear of the mortgage out-of getting signed.

Then, the lending company will only provide your much money, and so the quotes must be on address. The borrowed funds organization also will need multiple pieces of documents that show that the latest contractor is actually capable to do the performs. A knowledgeable company is not the least expensive: It will be the individual who does the job just at a fair speed, and will satisfy the underwriter’s documents standards.