As opposed to more sorts of funding alternatives, it’s not necessary to tell your financial how you’re utilising the currency when taking away property collateral personal line of credit. Instance, when you take away a car loan, you can not select that you’d alternatively make use of the money to blow off student loan personal debt after you get the money. With a beneficial HELOC, you should use the bucks for many techniques from level program debts over a period of financial instability in order to renovating your kitchen. There are no restrictions regarding how you utilize the money.

Refills since you need They

Plus like credit cards, you have access to the HELOC over time since you need it providing you consistently pay your debts. This provides you with a more flexible resource choice, as possible access many times since you need supply to extra house fund.

If you are a great HELOC financing can supply you with an adaptable alternative having financial support life’s big instructions and you can expenditures, it comes which includes considerations you’ll want to know as the latest homeowner. Here are a few things to consider prior to signing towards the the fresh new dotted range.

High Pricing Than an interest rate

When you find yourself APRs for the HELOCs is lower than those that you can find into the playing cards, they are higher than financial rates. When you have a mortgage already, anticipate paying a higher rate of interest than your current financing if you decide to need good HELOC.

Supported by Your home

To help you qualify for a HELOC, you must provide your property just like the equity. This means that you can remove your residence for many who never repay their HELOC with regards to the regards to your arrangement. While just one overlooked payment with the a good HELOC wouldn’t result in the newest sheriff knocking on loans Redlands your own doorway, continuously missed costs include a significant likelihood of losing your the home of property foreclosure.

May cause Overspending

When you take out an excellent HELOC, it is possible to very first enjoy your loan in the draw several months. In the draw several months, it is possible to just need to make desire money on number of money that you acquire. Thus you can fundamentally spend as much as the HELOC’s restrict while also while making lowest costs equivalent to a small amount from accumulated attract.

Unfortuitously, your draw several months won’t last permanently. Following draw period comes to an end, you’ll want to start making lowest normal money with the amount of cash you owe, and additionally accumulated attract. Or even zero your debts between days, focus will continue to material for the matter you borrowed from, making you spend a whole lot more.

You may need to Shell out Settlement costs Once again

Same as once you re-finance, there is have a tendency to an ending techniques involved in starting an excellent HELOC. However some lenders enjoys received rid of HELOC closing costs, particular lenders can charge anywhere between 2% and 5% of one’s credit line equilibrium so you can accomplish their mortgage availableness.

The bottom line? When you are HELOCs provide you with fast access so you’re able to cash, you’ll need to be certain to monitor what you owe and make use of fund sensibly. If you’ve got dilemmas managing the purchasing that have playing cards during the going back, it might not getting a good idea to get a great HELOC. In place of credit cards, your HELOC financing is backed by your house. If you cannot build costs on your HELOC, you could run the risk out of losing your house to foreclosures.

Choosing the right HELOC Bank

Choosing the best HELOC lender was a choice that significantly effect your financial situation. Be sure to envision circumstances such as for instance interest levels, charge, support service, and you may reputation when selecting a lender. By-doing thorough lookup and you can evaluating different choices, discover a lender that meets your unique need and you will will give you a knowledgeable fine print for your house collateral line of credit. Usually meticulously review all terms and conditions prior to a final decision, and you will consult with a financial coach if needed.

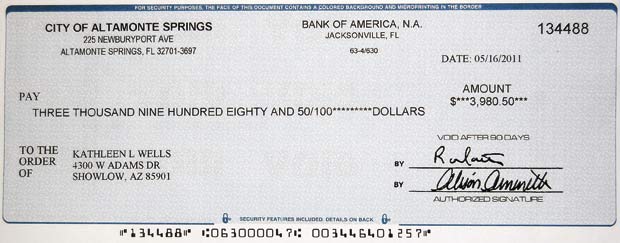

Bank from The united states supporting digital apps and it has a cellular banking app which allows you to definitely control your costs and you may tune the mortgage acceptance reputation on the go. If you find yourself an existing Lender out of The usa customers, your guidance will seamlessly populate about application having their HELOC. When you are shopping for calculating the expense of your own Financial out-of The usa HELOC, look at the businesses web site and use the home security adjustable Annual percentage rate otherwise house appraisal products. Only input certain private information, and devices usually estimate the interest rate.