Will you be a home upgrade venture but worried about the latest monetary burden it might demand? Search no further! On this page, we’re going to mention a normally overlooked alternative which can help you funds your residence developments: the 401k financing. By leveraging retirement savings, you might make the most of lower rates of interest, versatile fees conditions, and you can possible tax professionals. Subscribe united states while we delve into the advantages, constraints, and you can methods to track down an excellent 401k loan to have do-it-yourself, and additionally beneficial methods for maximizing its play with.

Benefits of using an effective 401k Mortgage having Home improvement

In terms of resource your house update opportunity, a great 401k financing has the benefit of numerous appealing advantages making it a great popular choice for of many property owners.

Lower Interest rates Compared to Almost every other Mortgage Possibilities

One of many significant benefits of a 401k financing ‘s the generally speaking straight down interest rates in comparison to almost every other loan alternatives, including personal loans otherwise credit cards. This means that borrowing from your 401k can save you an excellent substantial amount of cash from inside the appeal costs over the loan term, therefore it is a cost-productive services for your house improve means.

Zero Credit score assessment otherwise Being qualified Requirements

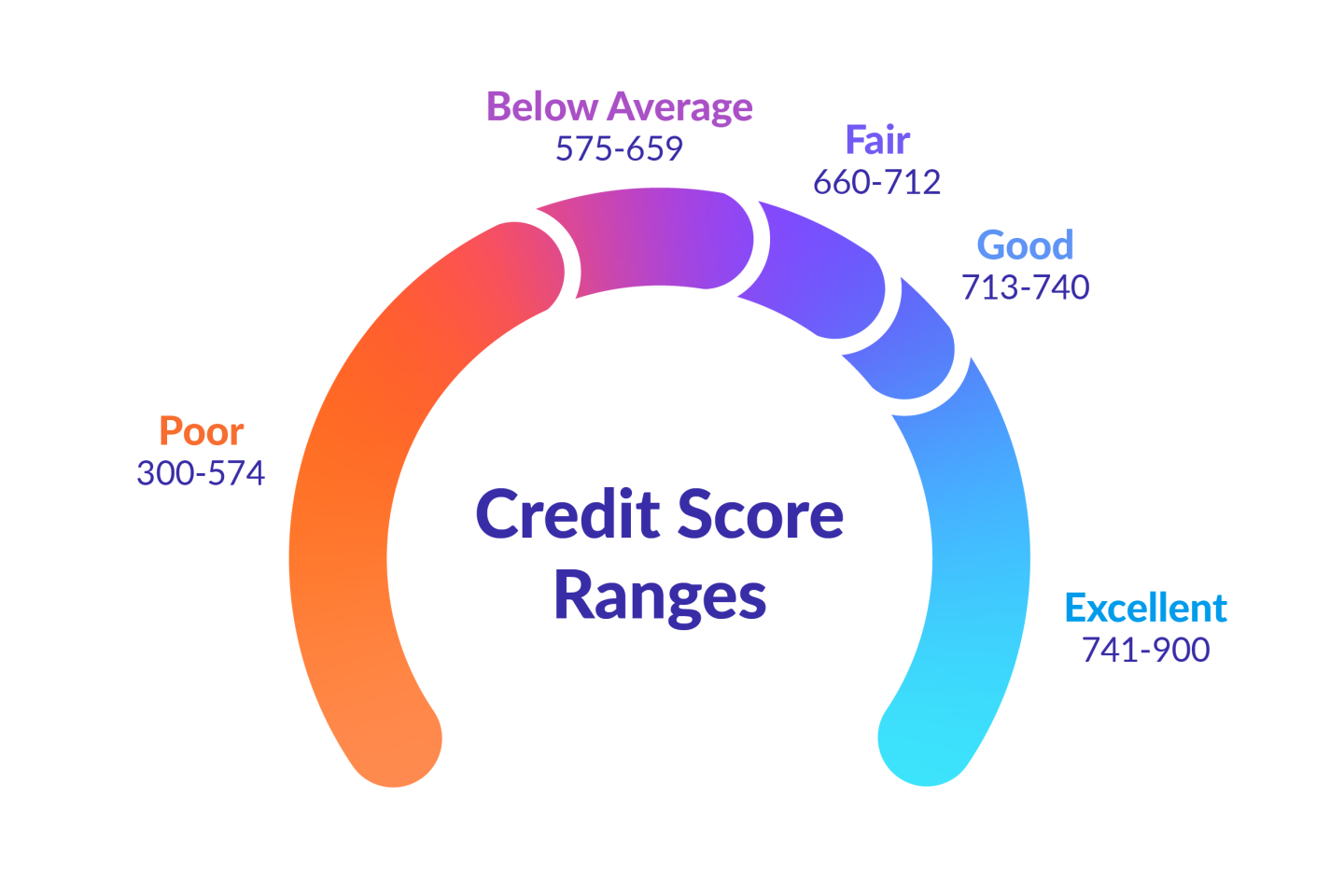

Unlike conventional financing, a good 401k loan doesn’t need a credit assessment or stringent being qualified standards. This makes it an obtainable option for individuals with less-than-best credit scores or people who might have difficulties meeting the fresh qualification criteria of other loan apps. Your retirement offers serve as guarantee, removing the need for extensive papers and you may borrowing assessments.

Flexibility in the Fees Terminology

401k financing promote flexibility for the fees terms and conditions, enabling custom loans Clanton AL you to personalize the mortgage to the financial predicament. You might generally pay back the mortgage over a period of five years, although some agreements may continue the new payment period getting renovations. It added independence implies that you could potentially easily take control of your loan money whenever you are nevertheless progressing towards your advancing years wants.

Possible Taxation Benefits

A different sort of appealing aspect of using a beneficial 401k financing to own do-it-yourself is the prospective taxation gurus it could provide. If you find yourself contributions to help you a great 401k are generally produced for the an excellent pre-taxation basis, mortgage money are designed with immediately following-tax cash. Yet not, whenever paying off the borrowed funds, the attention you only pay is not subject to tax, effortlessly cutting your nonexempt money. Which taxation virtue is further improve the costs-capabilities of utilizing a beneficial 401k financing for your home upgrade opportunity.

Knowing the Constraints off a good 401k Financing having Home improvement

Whenever you are an excellent 401k mortgage is going to be a practical choice for financial support your home improve enterprise, it is vital knowing the constraints and you can potential cons in advance of making a choice.

Prospective Fines

Providing financing from your 401k will get involve penalties and fees. If you fail to pay back the borrowed funds according to concurred-upon terminology, it’s also possible to face charges and you can taxes toward an excellent harmony. At the same time, particular companies can charge administrative fees getting control the borrowed funds. You will need to very carefully review the fresh new conditions and terms regarding your own 401k financing just before investing in always know any possible penalties and fees.

Affect Old-age Deals

Borrowing from the bank from your 401k can impact your retirement offers in many suggests. To start with, extent you acquire tend to briefly reduce the money available for resource, possibly affecting the development of your old age nest egg. Next, if you leave your work otherwise are ended, the latest the loan equilibrium can be due instantly. Failing woefully to repay the loan in the given time frame can also be produce they being treated due to the fact a shipment, subjecting you to definitely taxes and you can prospective very early detachment punishment.